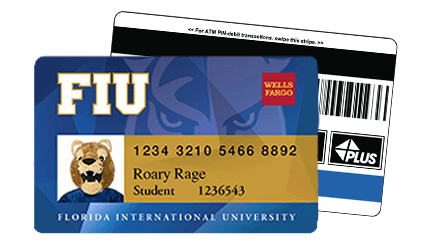

Florida International University and Wells Fargo have teamed up to offer you optional banking convenience with your linked FIU One Card. Use it as your official student ID, for campus privileges, and for your day-to-day financial needs on and off campus when it’s linked to a Wells Fargo checking account, with two account options for students. Enjoy no-fee cash access at Wells Fargo ATMs, including the Wells Fargo ATMs on campus. Make purchases using your Personal Identification Number (PIN) with your linked FIU One Card. Take advantage of this optional benefit today.

Options & Features

The Wells Fargo Campus Card Program offers a convenient way to access your money on and off campus, plus exclusive benefits. See more details about how we’re making college life a little easier, and find out more by watching our video about the Campus Card Program.

Access to additional services such as:

- Τhe Wells Fargo Mobile® app to check account activity, deposit checks3, transfer funds4, pay bills, send money with Zelle®5 in our mobile app, and set up push notifications, text, or email alerts6.

- Helpful online financial educational resources and money management tools.

- CollegeSTEPS® guidance and resources to help you take control of your college finances, including exclusive access to over 7 million scholarships.

Plus, when linking a FIU One Card to an Everyday Checking account, you'll receive additional benefits:

- Νο monthly service fee charged.7

- No Wells Fargo fees for up to four cash withdrawals per monthly fee period from non-Wells Fargo ATMs in the U.S.8,9

- Receive a courtesy refund on one overdraft fee incurred during each calendar month.8,10

- Receive a courtesy refund on one incoming domestic or international wire transfer fee during each calendar month.8,11

Regulations

| 2023 Financial Disclosure Form | 2022 Award Year Contract Data | FIU/Wells Fargo Contract |

1. The FIU One Card is an official school ID and a Wells Fargo Campus Card when linked to a Wells Fargo checking account.

2. Minimum opening deposit is $25. Monthly service fee for the Everyday Checking account is $10 and can be avoided when the primary account owner is 17 through 24 years old. Monthly service fee for the Clear Access Banking account is $5 and can be avoided when the primary account owner is 13 through 24 years old. When the primary account owner reaches the age of 25, age can no longer be used to avoid the monthly service fee. Everyday Checking customers have other ways to avoid the monthly service fee. Customers between 13 and 16 years old must open the Clear Access Banking account with an adult co-owner. See a Wells Fargo banker or the Consumer Account Fee and Information Schedule available at wellsfargo.com/depositdisclosures for more information about other fees that may apply and options to avoid the monthly service fee.

3. Mobile deposit is only available through the Wells Fargo Mobile® app. Deposit limits and other restrictions apply. Some accounts are not eligible for mobile deposit. Availability may be affected by your mobile carrier’s coverage area. Your mobile carrier’s message and data rates may apply. See Wells Fargo’s Online Access Agreement for other terms, conditions, and limitations.

4. Terms and conditions apply. Setup is required for transfers to other U.S. financial institutions, and may take 3 – 5 days. Customers should refer to their other U.S. financial institutions for information about any potential transfer fees charged by those institutions. Mobile carrier’s message and data rates may apply. See Wells Fargo’s Online Access Agreement for more information.

5. Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Terms and conditions apply. U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®. The Request feature within Zelle® is only available through Wells Fargo using a smartphone. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution’s online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. Your mobile carrier’s message and data rates may apply.

6. Sign up may be required. Availability may be affected by your mobile carrier’s coverage area. Your mobile carrier’s message and data rates may apply.

7. You will avoid the Everyday Checking account’s monthly service fee within 45 days of linking your [Card Name] to that account. See a Wells Fargo banker or the Consumer Account Fee and Information Schedule available at wellsfargo.com/depositdisclosures for more information about other fees that may apply and options to avoid the Everyday Checking account’s monthly service fee.

8. These benefits will take effect within 45 days following the linkage of your Campus Card to an Everyday Checking account. Your Everyday Checking account must be linked to an open, active Wells Fargo Campus Card to remain eligible and receive these benefits. Your benefits will end 60 days after your Everyday Checking account is no longer linked to an active Campus Card. In that event, the Bank’s standard terms and fees apply. Ask a banker for additional details.

9. Non-Wells Fargo ATM owner/operator fees may apply.

10. Our overdraft fee for Consumer checking accounts is $35 per item (whether the overdraft is by check, ATM withdrawal, debit card transaction, or other electronic means). We charge no more than three overdraft fees per business day. Overdraft fees are not applicable to Clear Access Banking℠ accounts. The payment of transactions into overdraft is discretionary and we reserve the right not to pay. For example, we typically do not pay overdrafts if your account is overdrawn or you have had excessive overdrafts. You must promptly bring your account to a positive balance.

11. In addition to any applicable fees, Wells Fargo makes money when we convert one currency to another currency for you. The exchange rate used when Wells Fargo converts one currency to another is set at our sole discretion, and it includes a markup. The markup is designed to compensate us for several considerations including, without limitation, costs incurred, market risks, and our desired return. The applicable exchange rate does not include, and is separate from, any applicable fees. The exchange rate Wells Fargo provides to you may be different from exchange rates you see elsewhere. Different customers may receive different rates for transactions that are the same or similar, and the applicable exchange rate may be different for foreign currency cash, drafts, checks, or wire transfers. Foreign exchange markets are dynamic and rates fluctuate over time based on market conditions, liquidity, and risks. Wells Fargo is your arms-length counterparty on foreign exchange transactions. We may refuse to process any request for a foreign exchange transaction.

Incoming wire transfers received in a foreign currency for payment into your account will be converted into U.S. dollars using the applicable exchange rate without prior notice to you.

For additional information related to Wires and foreign currency wires, please see the Wells Fargo Wire Transfers Terms and Conditions.

Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Wells Fargo may provide financial support to Florida International University for services associated with the FIU One Card.

Wells Fargo Bank, N.A. Member FDIC.

Locations

Modesto Maidique – PG1 Gold Garage, First Floor

Biscayne Bay – Wolfe University Center 143

Connect with Us

Modesto Maidique – 305-348-2273

Biscayne Bay – 305-919-5406

ATM Locations

Modesto Maidique – PG1 | GC | PG5

Biscayne Bay – WUC